How to Trade Futures on MEXC

Futures trading is a dynamic and potentially lucrative endeavor, offering traders the opportunity to profit from price movements in various financial assets. MEXC, a leading cryptocurrency derivatives exchange, provides a robust platform for traders to engage in futures trading with ease and efficiency. This comprehensive guide aims to equip you with the knowledge and skills necessary to navigate the world of futures trading on MEXC successfully.

What is Futures Trading

- Futures are a form of derivative contracts that require the trading sides to complete a transaction of an asset at a fixed date and rate in the future. The buyer and seller have to follow the price set when the future contract is booked. This condition means that the price decided in the contract must be paid, regardless of the asset’s current price.

- These contracts, applicable to physical commodities or financial instruments, specify the quantities involved and are typically traded on futures exchanges such as MEXC.

- Futures serve as popular instruments for safeguarding against declining market prices and mitigating risks associated with price fluctuations in regular trades.

How does Futures work on MEXC

- Futures contracts let traders fix the price of the asset in the contract. This asset can be any commonly traded commodity like oil, gold, silver, corn, sugar, and cotton. The underlying asset can also be shares, currency pairs, cryptocurrency, and treasury bonds.

- A futures contract would lock in the price of any of these assets at a future date. A standard future contract has a maturity date, also known as its expiry and set price. The maturity date or month is commonly used to identify futures.

For instance

Corn futures contracts expiring in January are called January corn futures.

- As a future contract buyer, you will be bound to take ownership of the commodity or asset at the contract’s maturity. This ownership can be in cash terms and does not always have to be physical asset ownership.

- The main point to remember is that buyers can sell their futures contract to someone else and free themselves from their contractual obligation.

Why do traders choose Futures?

Futures trading provides many benefits that attract investors of all types. Because futures derive their value from financial or physical assets, they are great for managing risk and hedging in cryptocurrency mining and trading. This risk management aspect makes futures trading more efficient in terms of minimizing risk.

How to Open a Futures Trading on MEXC

1. Login

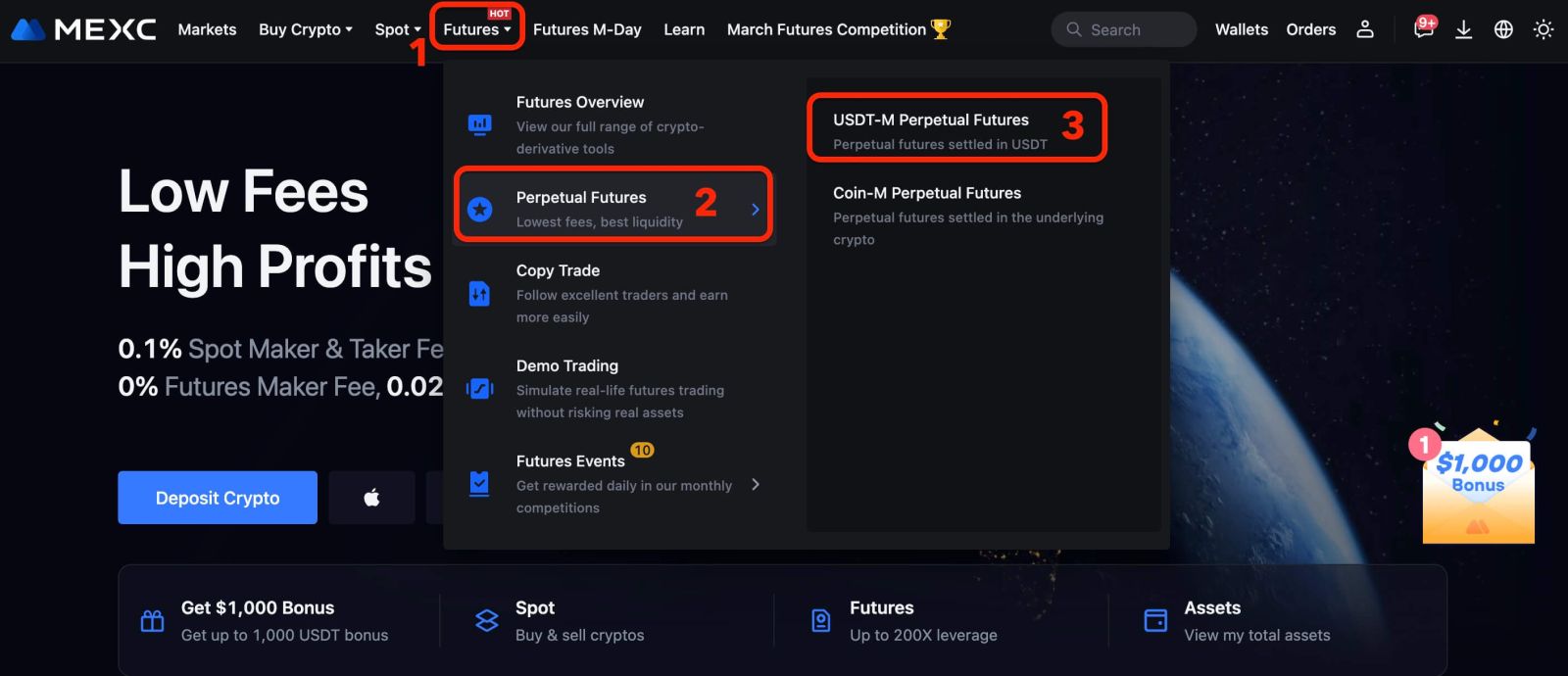

Visit the MEXC website using a browser, click [Futures], and select [USDT-M Perpetual Futures] to enter the live futures trading page.

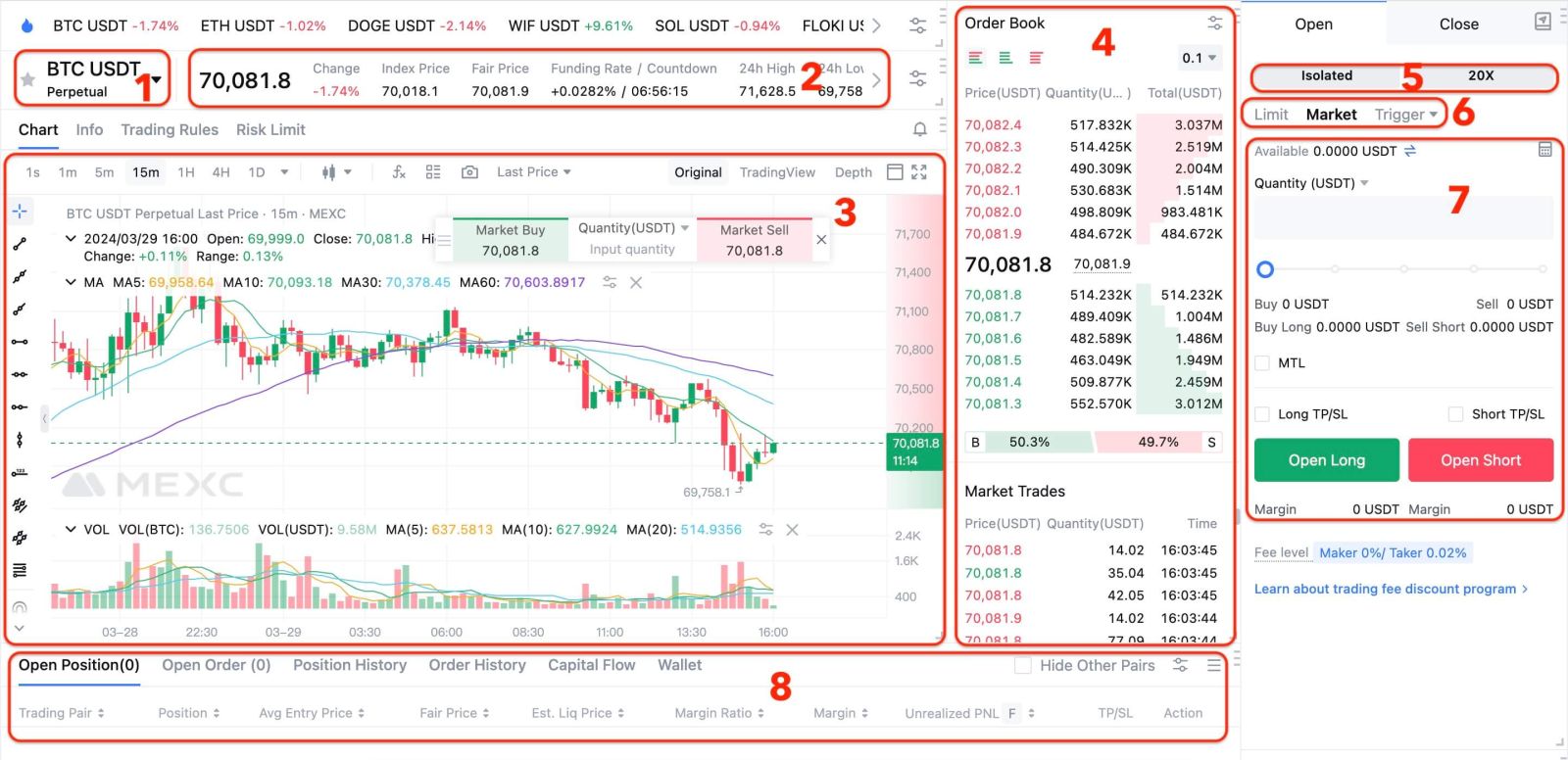

- Trading Pairs: Shows the current contract underlying cryptos. Users can click here to switch to other varieties.

- Trading Data and Funding Rate: Current price, highest price, lowest price, increase/decrease rate, and trading volume information within 24 hours. Display the current and next funding rates.

- TradingView Price Trend: K-line chart of the price change of the current trading pair. On the left side, users can click to select drawing tools and indicators for technical analysis.

- Orderbook and Transaction Data: Display the current order book and real-time transaction order information.

- Position and Leverage: Switching of position mode and leverage multiplier.

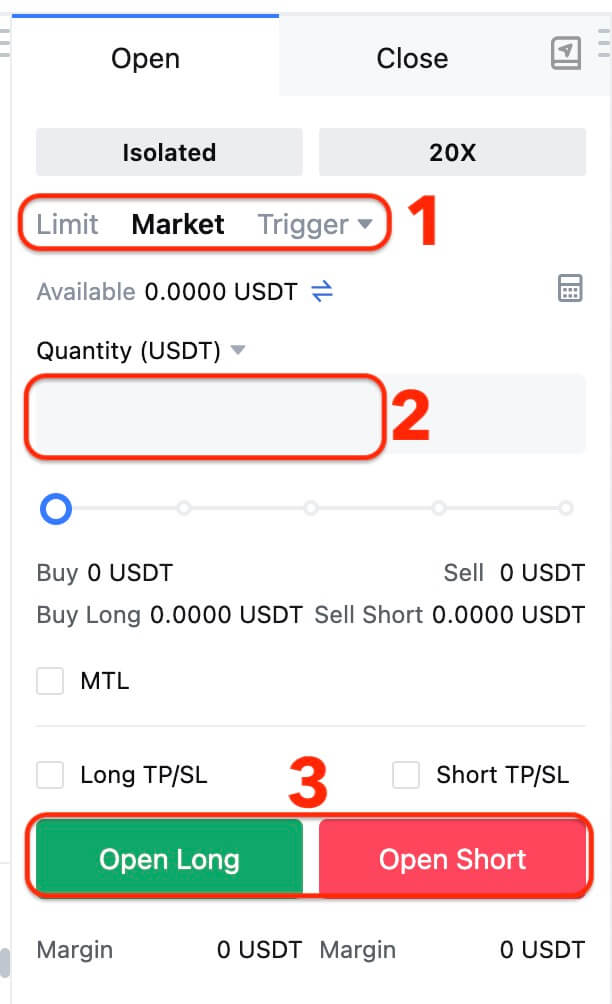

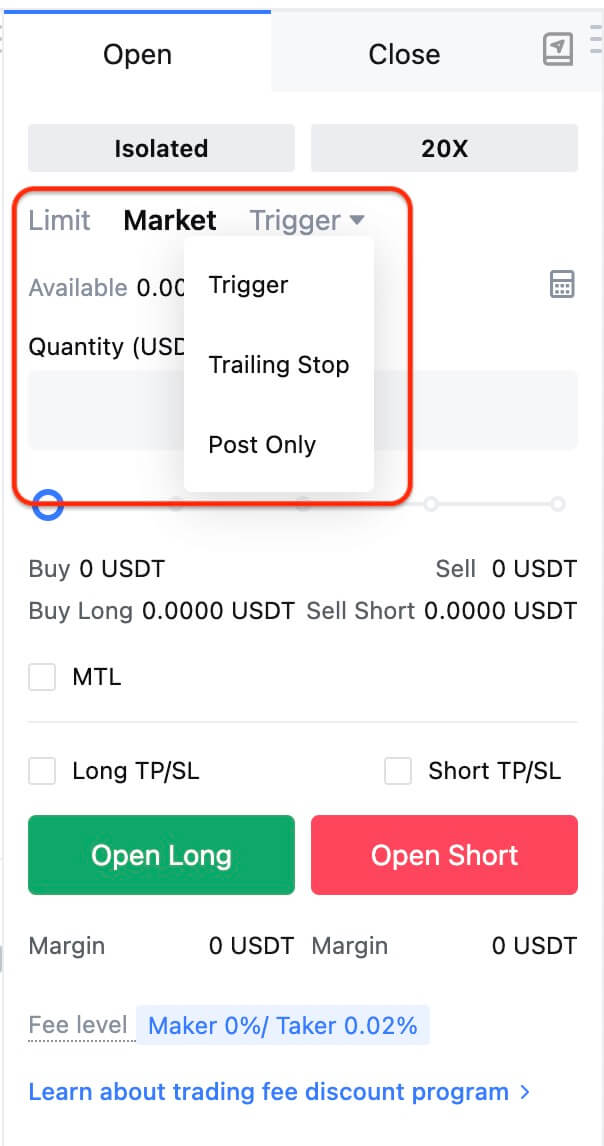

- Order type: Users can choose from a limit order, market order, and trigger.

- Operation panel: Allow users to make fund transfers and place orders.

- Position and Order information: Current position, current orders, historical orders and transaction history.

2. Trading

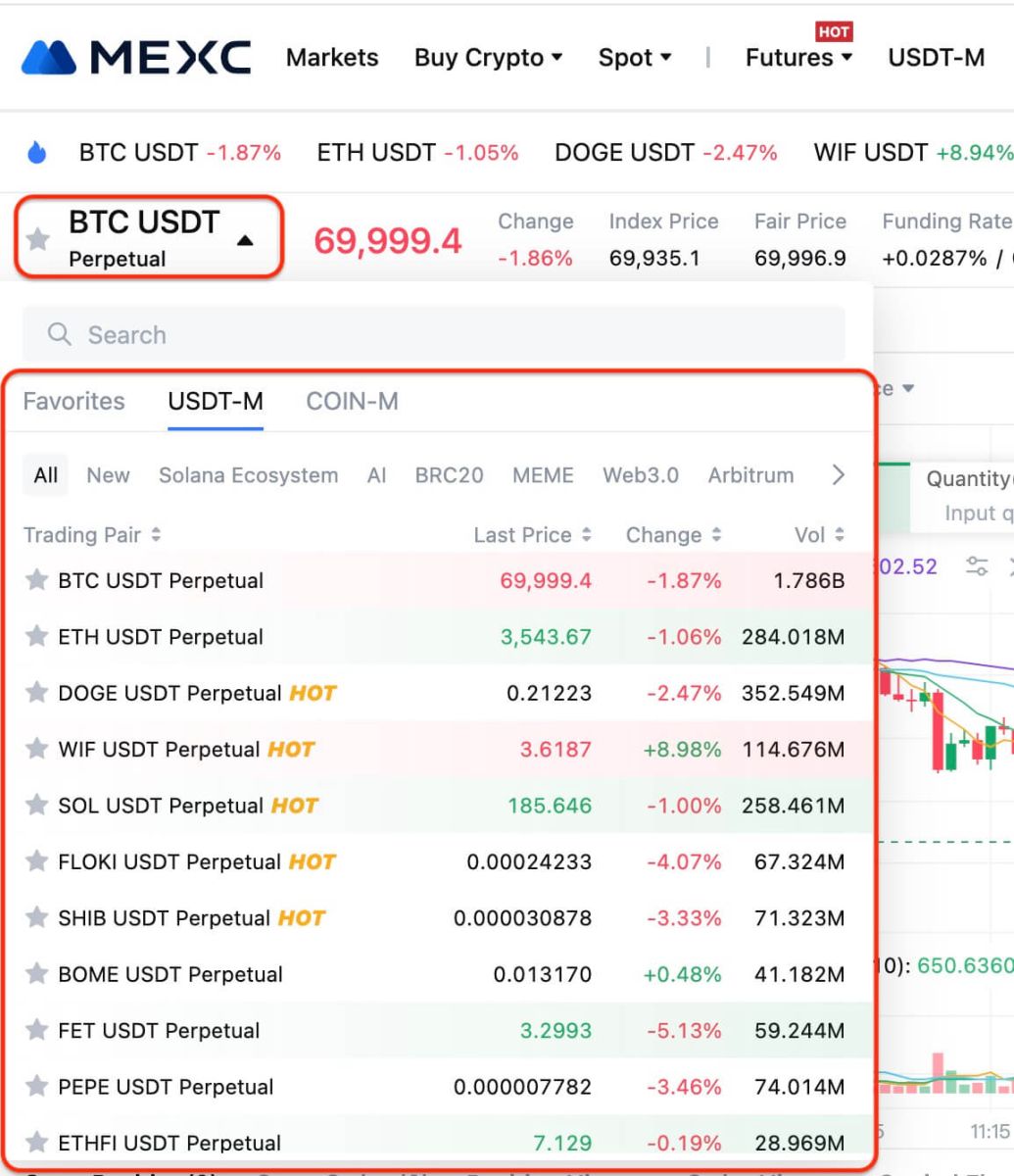

MEXC perpetual futures include USDT-M futures and Coin-M futures. USDT-M futures are perpetual futures where USDT is used as the margin. Coin-M futures are perpetual futures where the corresponding digital assets are used as the margin. Users can choose different trading pairs and engage in trading based on their needs.

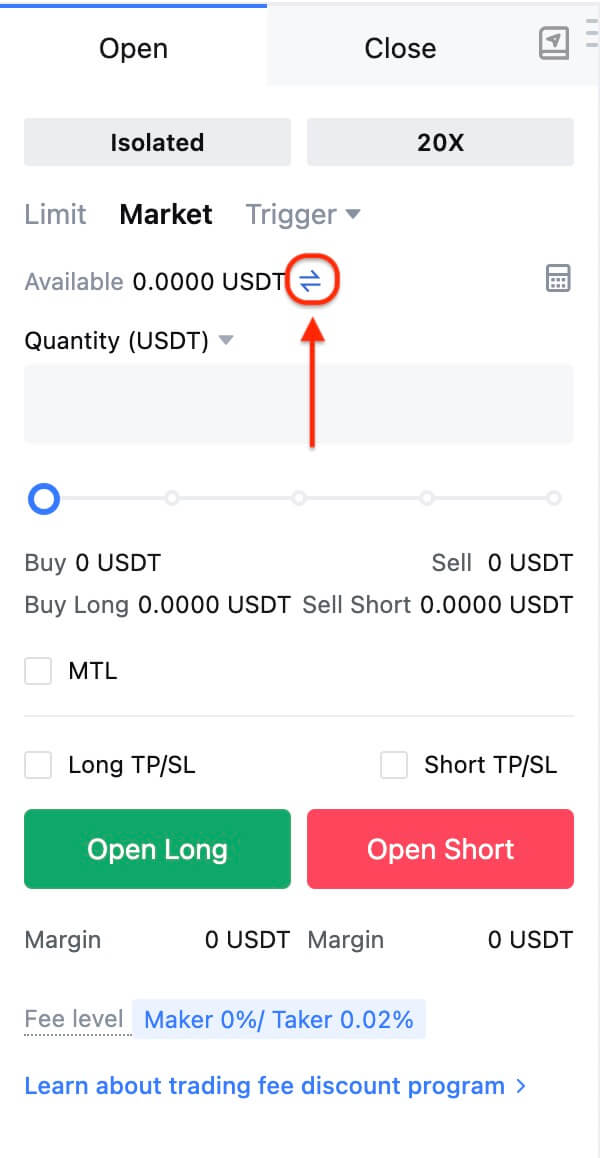

For fund transfers, if your have insufficient available funds, you can transfer funds from your spot account to your futures account. If there are no funds available in your spot account, you can top-up or trade fiat currency first.

To place an order, fill in the order information on the order panel (including selecting the order type, price, and quantity), then submit the order.

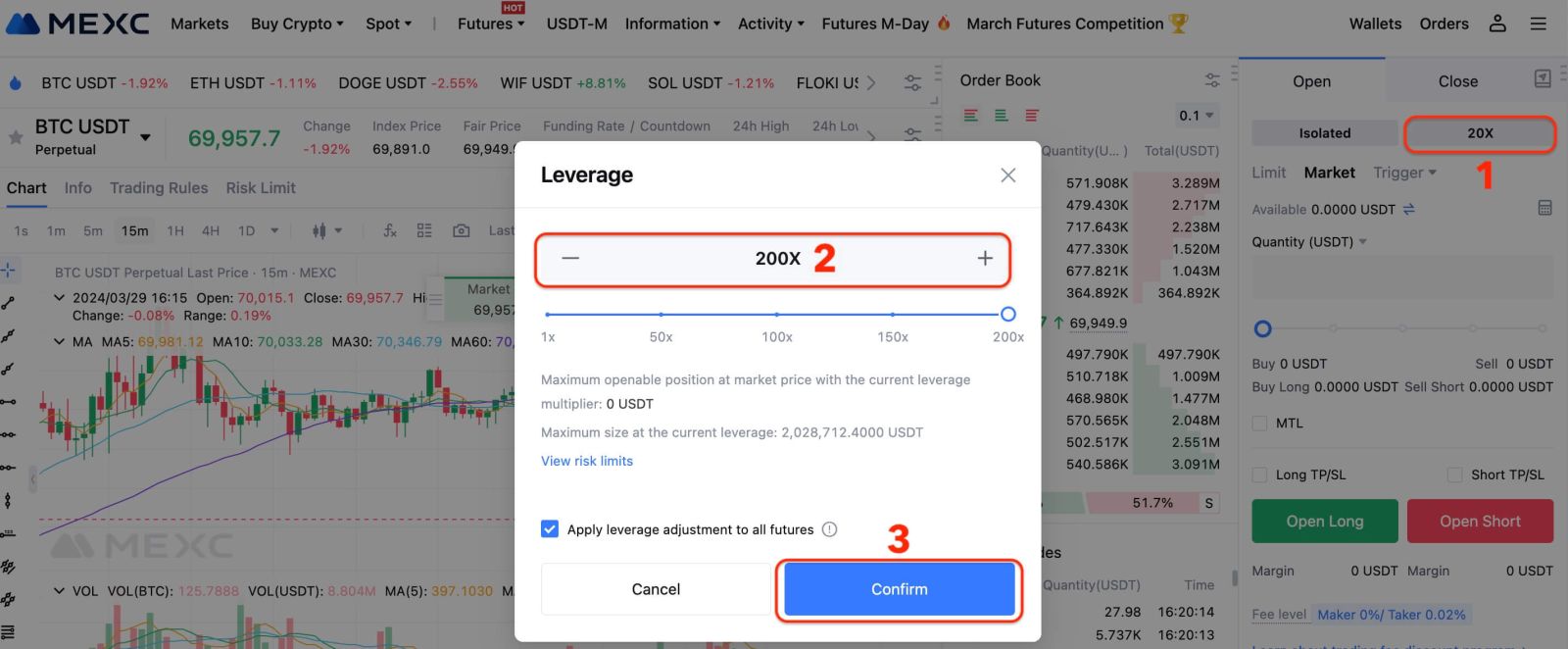

3. Leverage

MEXC perpetual futures support leverage of up to 200x. The leverage multiplier may vary depending on the futures trading pair. The leverage is determined by the initial margin and maintenance margin levels. These levels determine the minimum funds required for opening and maintaining a position.

*Currently, in hedge mode, users can utilize different leverage multipliers for long and short positions. MEXC also allows users to switch between different margin modes, such as isolated margin mode and cross margin mode.

3.1 How to Adjust the Multiplier

Example: If you currently have a long position with 30x leverage and you want to reduce the risk by hedging, you can adjust the leverage from 30x to 20x. Click the [Long 30X] button and manually adjust the desired leverage ratio to 20x. Finally, click [Confirm] to adjust the leverage of your long position to 20x.

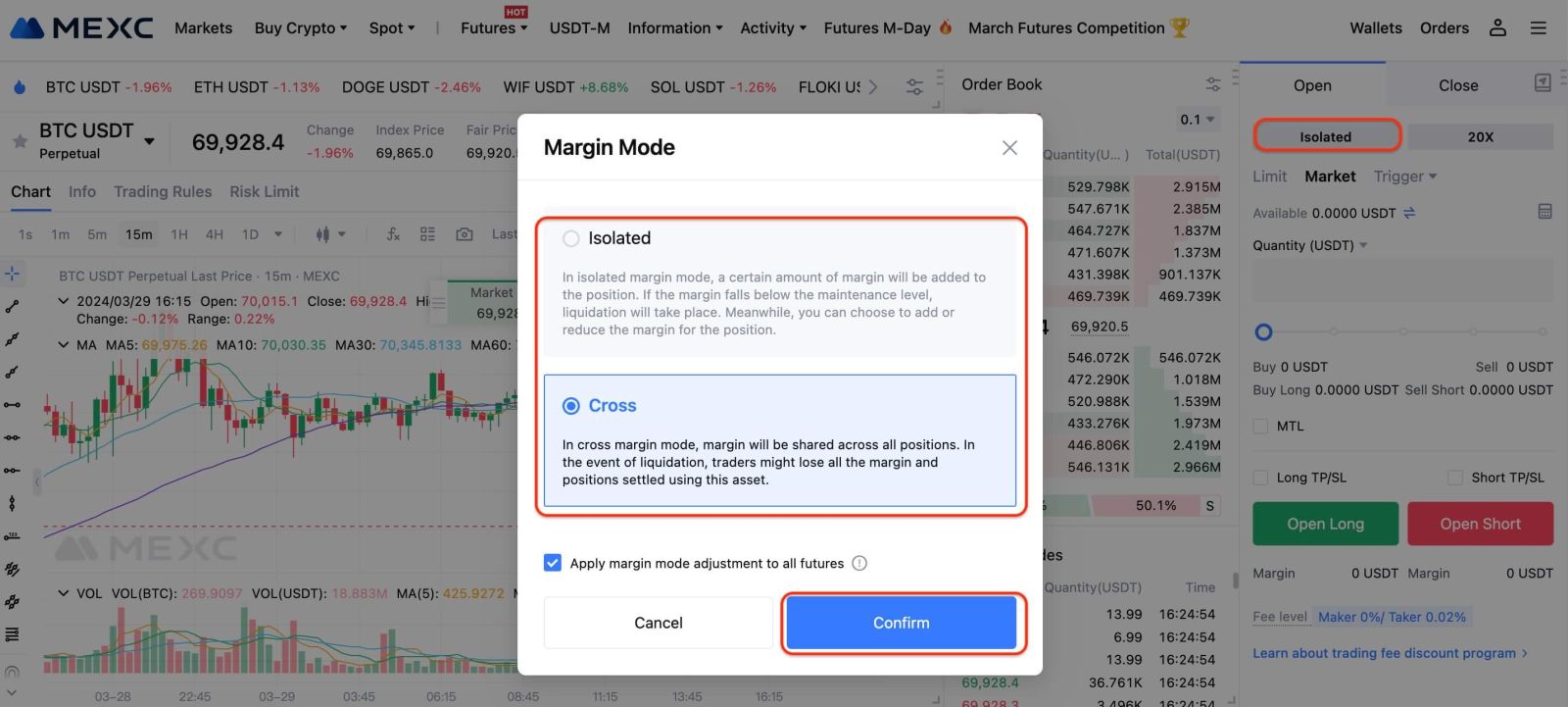

4. Cross Margin Mode

In cross margin mode, the entire account balance is used as margin to support all positions, thus preventing forced liquidation. Under this margin mode, if the net asset value is insufficient to meet the maintenance margin requirement, a forced liquidation will be triggered. If a cross margin position is liquidated, the user will incur losses on all assets in the account, excluding the margin reserved for other isolated margin positions.

5. Isolated Margin Mode

In isolated margin mode, the maximum loss is limited to the initial margin and additional margin used for that specific isolated margin position. If a position undergoes forced liquidation, the user will only lose the margin reserved for the isolated margin position, and the account balance will not be used for additional funds. By isolating the margin for a specific position, you can limit the potential losses to that position, which can be helpful in case your short-term speculative trading strategy fails.

Users have the option to manually add margin to their isolated margin positions, which can help optimize the liquidation price.

*By default, the system operates in isolated margin mode. Clicking the [Cross] button will switch the mode to cross margin mode.

*Currently, MEXC perpetual futures support switching from isolated margin to cross margin. However, please note that it is currently not possible to switch from cross margin mode to isolated margin mode.

5.1 Adjusting Isolated Positions

Currently, users can use different leverage ratios for long and short positions. They can adjust leverage ratios for any position from cross leverage to isolated leverage.

5.2 How to Switch

Example: If you currently have a long BTC/USDT futures position with 30x leverage, and you want to switch from isolated margin mode to cross margin mode, click [Long 30X], click [Cross], then click on [Confirm] to complete the switch.

6. Opening Long And Short Positions

6.1 Going Long (Buy)

If a trader predicts that the future market price will rise, they go long by buying a certain quantity of futures. Going long involves buying futures at an appropriate price and waiting for the market price to increase before selling (closing the position) to profit from the price difference. This is similar to spot trading and is often referred to as "buy first, sell later."

6.2 Going Short (Sell)

If a trader predicts that the future market price will decline, they go short by selling a certain quantity of futures. Going short involves selling futures at an appropriate price and waiting for the market price to decrease before buying (closing the position) to profit from the price difference. This is often referred to as "sell first, buy later."

If you have completed these steps, congratulations! At this point, you have traded successfully!

7. Orders

MEXC Futures offers multiple order types to fully satisfy users’ trading needs.

7.1 Limit Order

A limit order allows users to set a specific price at which they want their order to be executed. The order will be filled at the specified price or a more favorable price if available.

When using a limit order, users can also choose the order time-in-force type based on their trading needs. The default option is GTC (Good-Till-Canceled), but there are other options available:

GTC (Good-Till-Canceled): This order remains active until it is fully executed or manually canceled.

IOC (Immediate-Or-Cancel): This order is executed immediately at the specified price or canceled if it cannot be filled completely.

FOK (Fill-Or-Kill): This order must be filled in its entirety immediately or canceled if it cannot be filled completely.

7.2 Market Order

A market order is executed at the best available price in the order book at the time of placing the order. It does not require the user to set a specific price, allowing for quick order execution.

7.3 Stop Order

A stop order is triggered when the selected benchmark price (market price, index price, or fair price) reaches the specified trigger price. Once triggered, the order will be placed at the specified order price (supports limit or market orders).

7.4 Post Only

A post-only order is designed to ensure that the order is placed as a maker order and does not immediately execute in the market. By being a maker, users can enjoy the benefits of receiving trading fees as a liquidity provider when their orders are filled. If the order would otherwise match with existing orders on the order book, it will be immediately canceled.

7.5 Trailing Stop Order

A trailing stop order is a strategy-based order that tracks the market price and adjusts the trigger price based on market fluctuations. The specific calculation for the trigger price is as follows:

For sell orders: Actual Trigger Price = Market’s Highest Historical Price - Trail Variance (Price Distance), or Market’s Highest Historical Price * (1 - Trail Variance %)(Ratio).

For buy orders: Actual Trigger Price = Market’s Lowest Historical Price + Trail Variance, or Market’s Lowest Historical Price * (1 + Trail Variance %).

Users can also choose the activation price for the order. The system will start calculating the trigger price only when the order is activated.

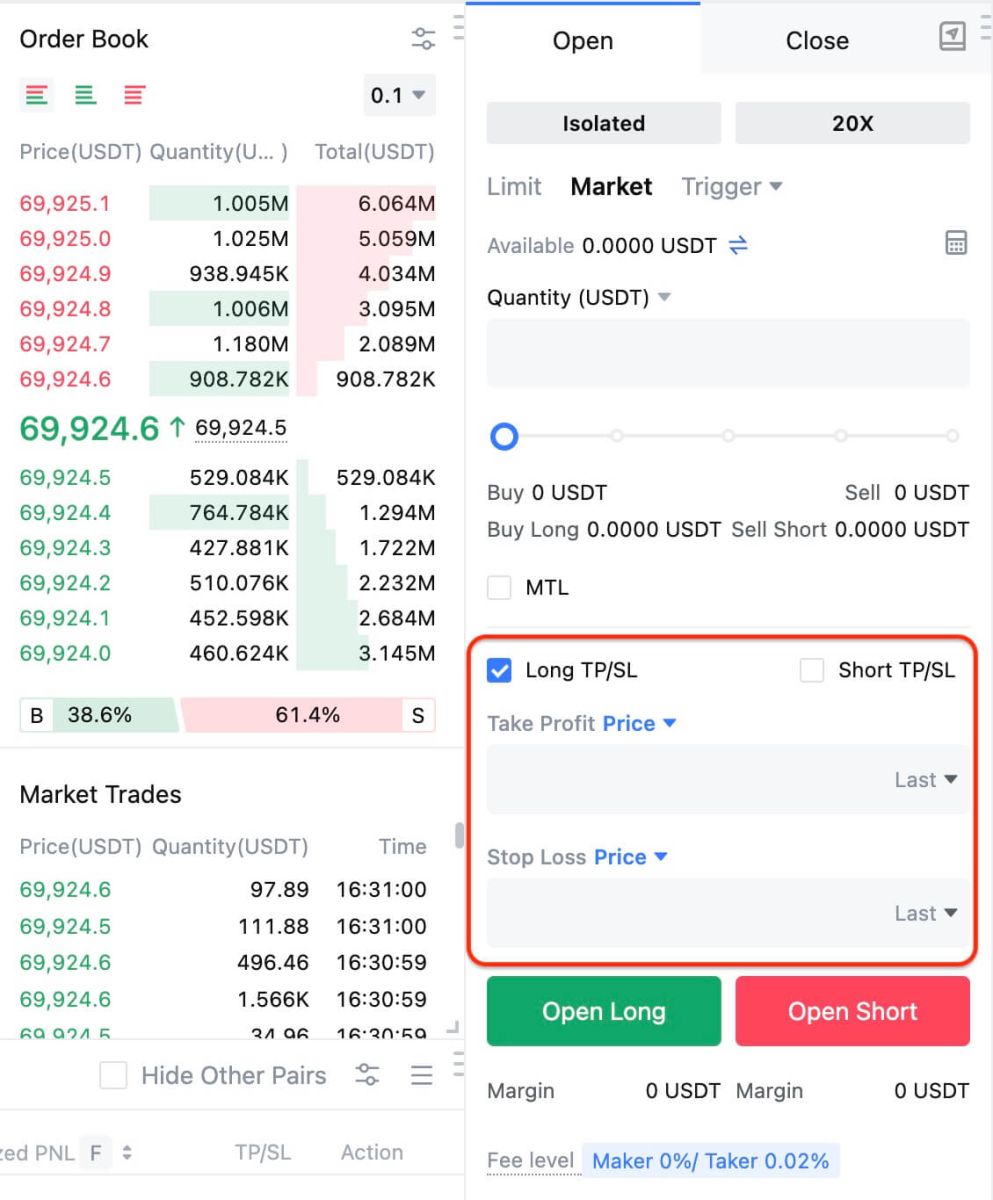

7.6 TP/SL Order

MEXC Futures supports setting both [Take Profit] and [Stop Loss] orders simultaneously. For example, when opening a long position on the BTC/USDT contract at a price of 26,752 USDT, you can set trigger prices for both [Take Profit] and [Stop Loss] orders.

What are the advantages of using perpetual contracts for investment? Let’s take a positive contract as an example:

Suppose traders A and B are participating in BTC trading at the same time, where A uses MEXC perpetual contracts, and B directly buys spot (equivalent to 1x leverage).

At the time of opening, the BTC price is 7000 USDT, and the opening value is 1 BTC for both A and B. The MEXC perpetual contract for BTC/USDT has a contract value of 0.0001 BTC per contract.

7.7 Buy/Long Case Example

Suppose the BTC price rises to 7500 USDT. Let’s compare the profit situations for trader A and trader B:

| Product | A - Perpetual Futures | B - Spot |

| Entry Price | 7000 USDT | 7000 USDT |

| Opening Value | 10000 cont.(approximately 1 BTC) | 1 BTC |

| Leverage Ratio | 100 x | 1x(No Leverage) |

| Required Capital | 70 USDT | 7000 USDT |

| Profit | 500 USDT | 500 USDT |

| Rate of Return | 714.28% | 7.14% |

7.8 Sell/Short Case Example

Suppose the BTC price drops to 6500 USDT. Let’s compare the profit situations for trader A and trader B:

| Product | A - Perpetual Futures | B - Spot |

| Entry Price | 7000 USDT | 7000 USDT |

| Opening Value | 10000 cont.(approximately 1 BTC) | 1 BTC |

| Leverage Ratio | 100 x | 1x(No Leverage) |

| Required Capital | 70 USDT | 7000 USDT |

| Profit | 500 USDT | - 500 USDT |

| Rate of Return | 714.28% | - 7.14% |

By comparing the above examples, we can see that trader A, using 100x leverage, only used 1% of the margin compared to trader B, yet achieved the same profit. This demonstrates the concept of "small investment, big return".

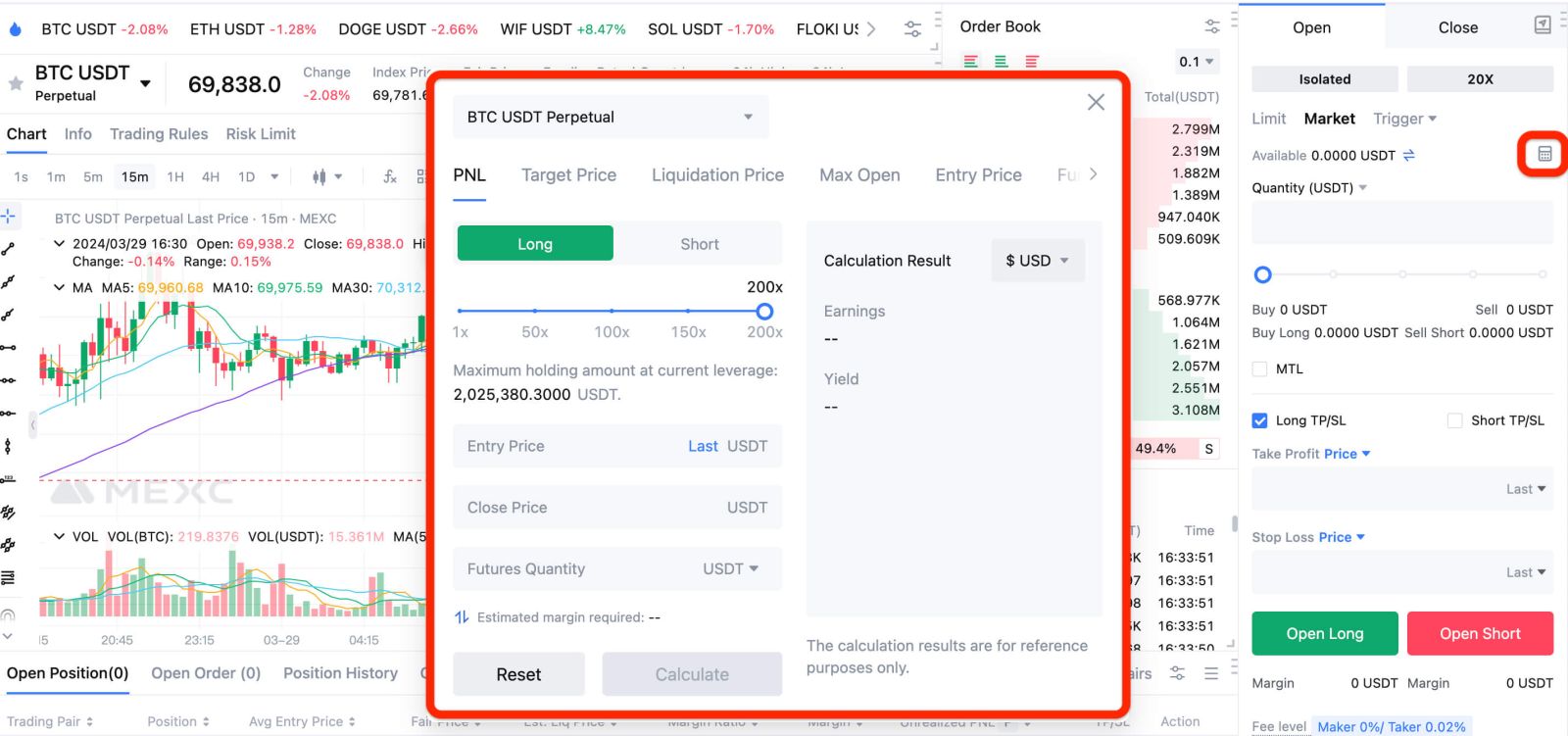

If you want to learn more about the data calculation results, you can use the "Calculator" feature available on our trading page.

Reminder

The system defaults to Isolated Margin Mode. You can change to the Cross Margin Mode by clicking the Cross Margin button. Please note that currently, MEXC perpetual futures allow users to switch from Isolated Margin to Cross Margin, but not from Cross Margin to Isolated Margin.